Build Apps or Trading Firms

— From Brian Huang, Co-Founder of Glider

There are two durable businesses to build in crypto these days: Apps or Trading Firms. Most infrastructure built over the past few years–account abstraction, paymaster/bundlers, social login, RPCs, DEXs + DEX aggregators, solvers–has become commoditized. These are middlemen and, taken ad infinitum, their margins will converge to zero.

This piece focuses on order flow because order flow dictates where value accrues. If you wanted a one-liner: apps create order flow and (eventually) trading firms consume it. How that order goes from A to B is what we will explore here. How it happens today, and how it will work in the future.

In this piece, I’ll explain traditional equity market structure: why/how does your trade on Robinhood end up at Citadel versus why/how Millennium’s (a hedge fund’s) trade ends up on the New York Stock Exchange (NYSE).

Why discuss traditional market structure as a reference? Despite how “novel” we think crypto market structure is, it has almost perfectly mirrored that of traditional markets (albeit we decided to coin new terms). “Positive Slippage” is just price improvement. “Prop AMMs” are just another flavor of single-dealer platforms. Batch auctions, like those on CowSwap, have existed for decades on Wall Street. None of this is new.

In the next few years, crypto will undergo inevitable market structure changes that shape where you should be building and investing. Order flow segregation, which I explain below, will force DEXs and DEX aggregators to rethink their businesses. While these changes won’t happen overnight, the end state is crystal clear. Let’s get into it.

US Equity Market Structure

For background, I started my career as a high frequency trader at XTX Markets and earlier as a bond trader at Morgan Stanley. I’ve traded liquid assets on almost every exchange in the world: equities, FX, commodity futures, treasuries/bonds, and crypto on the obvious major exchanges, but also tiny exchanges like South African Equities (JSE) or Japanese Metals (JPX). I find market structures fascinating. They define the rules of the game for trading firms. For the sake of this piece, we’ll just dial in on US equity market structure. It’s familiar and one of the most developed.

As mentioned in the intro, let’s first compare how your order on Robinhood is routed compared to how Millennium’s order might get routed.

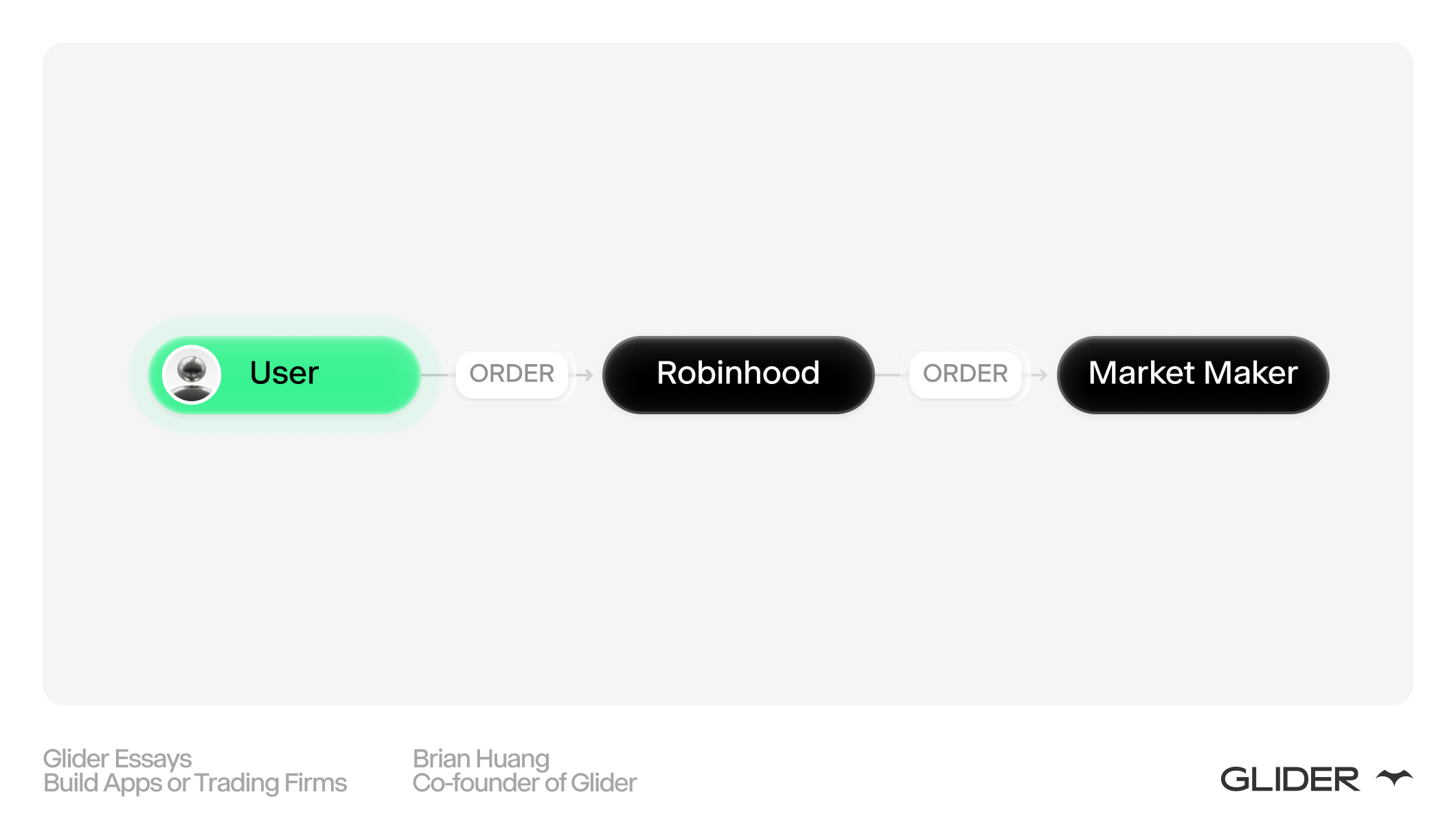

Your Trade on Robinhood:

Let’s start with what happens when you buy a share of Tesla ($TSLA) on Robinhood. Your order to buy one share of $TSLA must be matched with someone willing to sell a share. Behind the scenes, Robinhood is connected to a handful of market makers like Citadel and Virtu who can sell you that share. Today, your order gets routed to Citadel who sells you a share of $TSLA. (I’ll save the specifics for how Robinhood chooses which market maker gets your order for another time, it’s not important to know here). The trade is now complete, you bought a share of $TSLA from Citadel.

It’s important to know that by law, Citadel must give you the best execution under an SEC regulation called Reg NMS. They can’t make you buy $TSLA for $500 when it’s trading at $450. Reg NMS ensures that you, as a retail trader, always get the best price on the market (something that I think is incredibly important even in crypto).

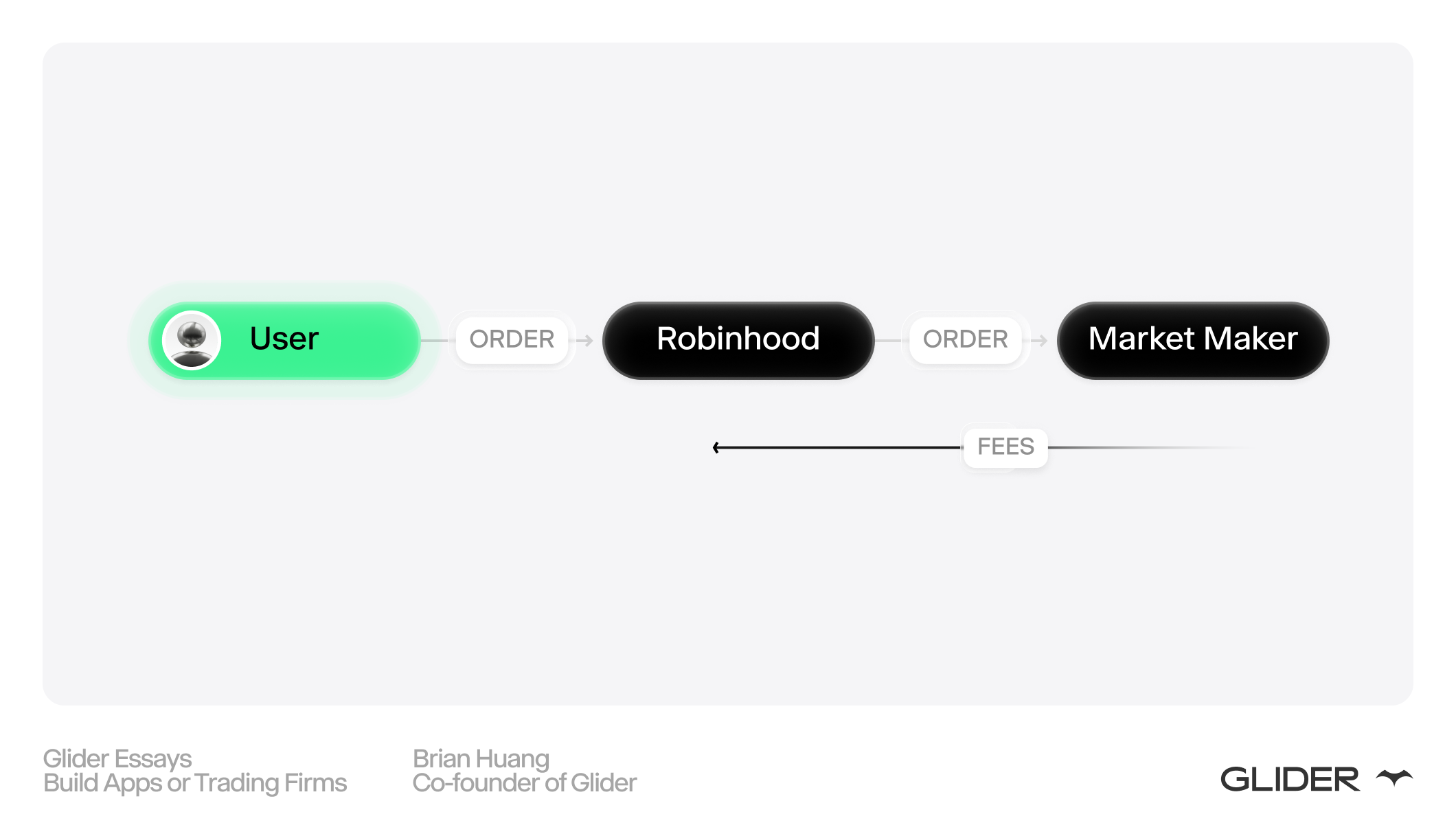

So you got your share of $TSLA, but what’s in this for Citadel and Robinhood? Citadel actually pays Robinhood for your order–it’s a process called payment for order flow (PFOF). Robinhood’s whole business is built around its ability to earn revenue from market makers.

Now why would Citadel pay for your order? Well, Citadel, like other market makers, is excellent at predicting short term price movements and constructing delta neutral portfolios. They believe $TSLA, over some time horizon, will go down in price. Not only that, they are willing to pay Robinhood for you to take the shares of $TSLA off their hands (or go short if they don’t already have a position).

I’m simplifying what Citadel does: rarely do firms like Citadel think about individual asset price movements, they may be trying to sell $TSLA for any number of reasons (i.e. the neural network said to).

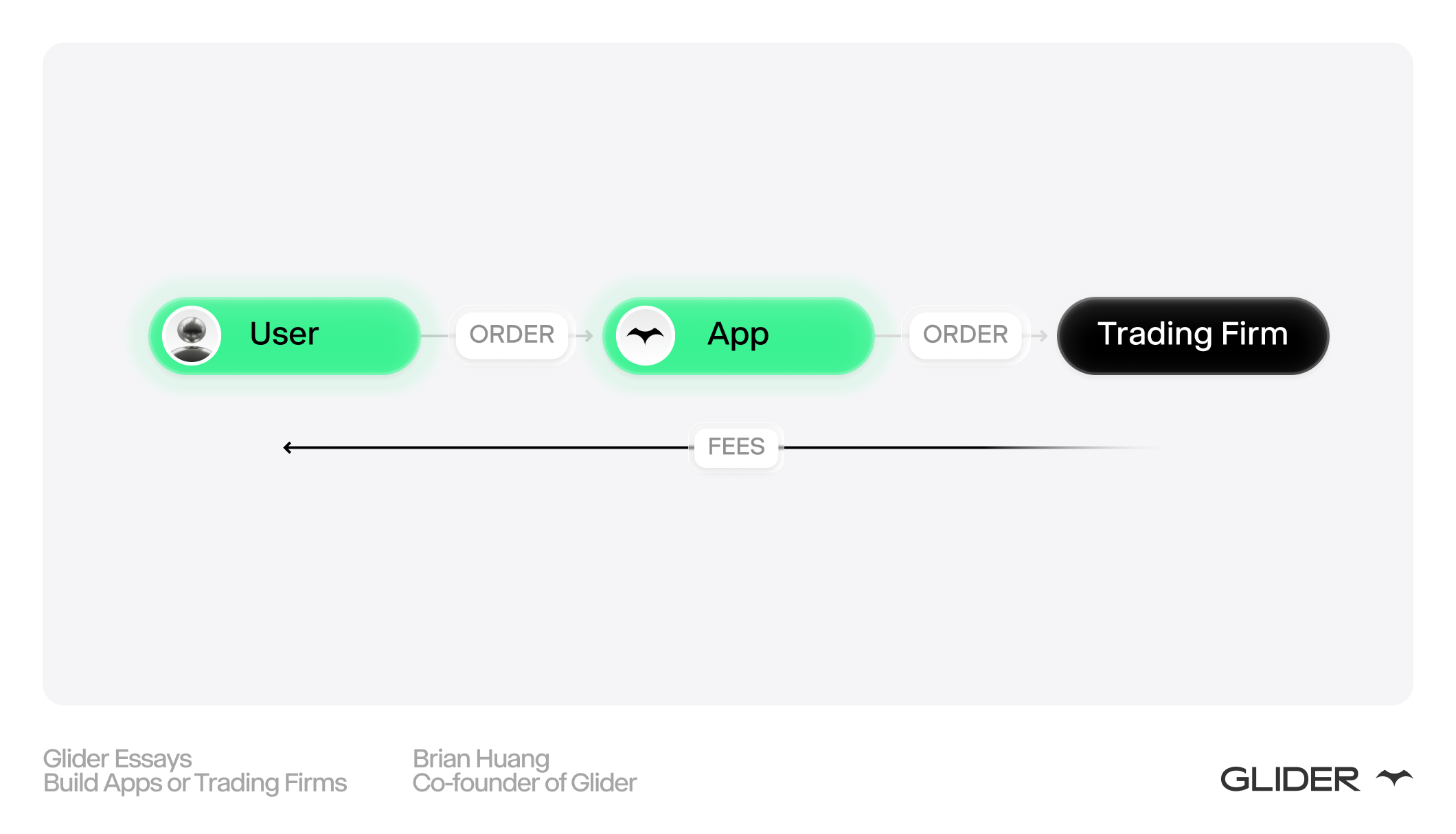

What’s important to know here is that the order flows from you through Robinhood (an app) to Citadel (a trading firm). Robinhood collects fees from Citadel and Citadel makes money from taking the other side of your trade. Now let’s compare this route to that of a hedge fund.

Millennium’s Trade on NYSE:

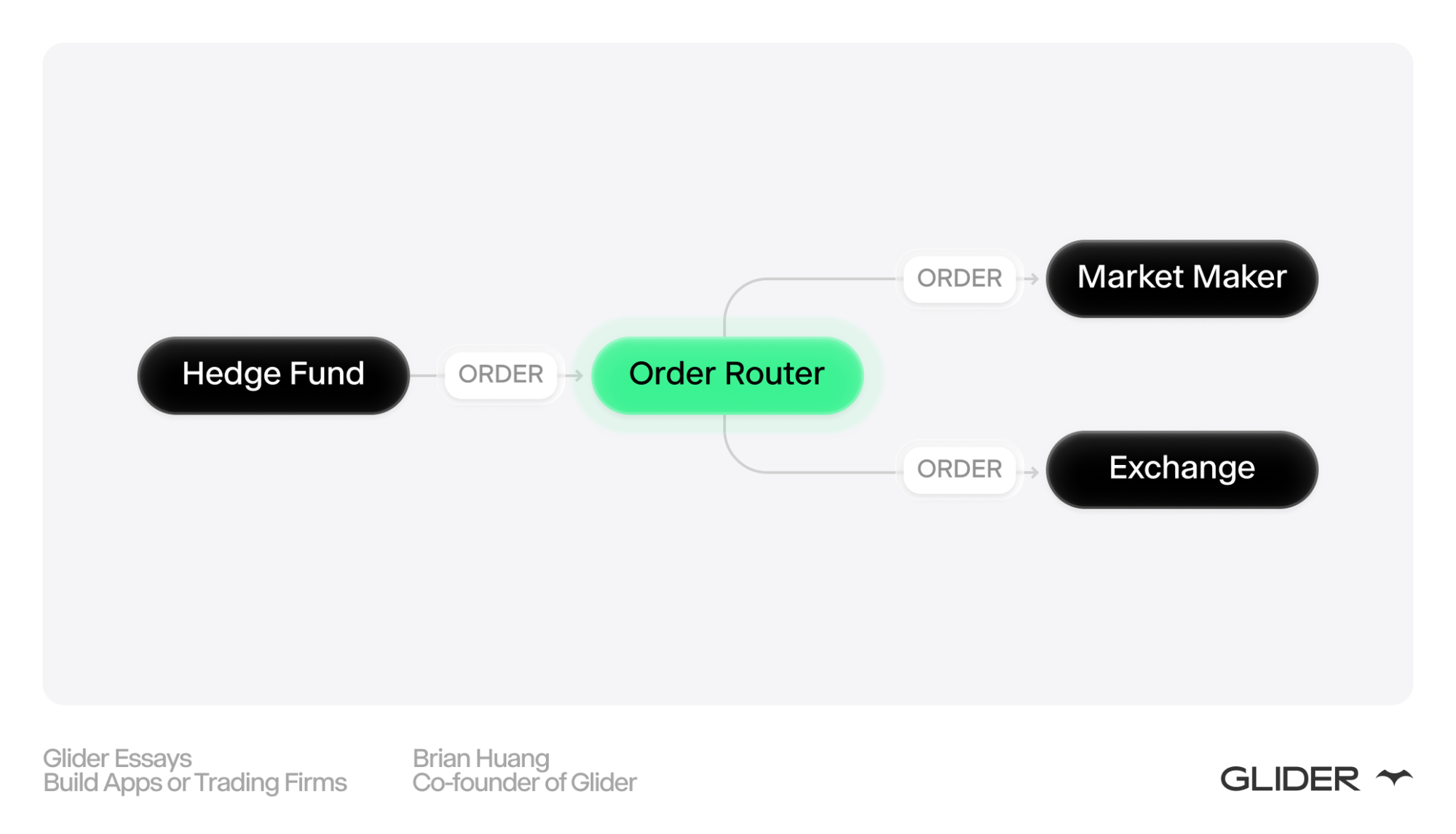

Millennium is a hedge fund. Similar to you, they are trading equities, however, they can’t open a Robinhood account. Instead, Millennium, like most hedge funds of its scale, has built its own order routing system in-house. This order routing system combines prices from all over the market and helps them decide where to send their orders.

Just like Robinhood, Millennium is connected to many market makers like Jump Trading, Jane Street, and Citadel. Millennium is also connected to exchanges like the NYSE or Nasdaq. When Millennium wants to buy 100 shares of $TSLA, they find the best prices available and either send the order in full to one place or break it into smaller pieces (there are reasons for this that I won’t elaborate on here). Ultimately, Millennium trades against a market maker or an exchange.

The key difference between you and Millennium is pricing and available liquidity. You, as retail, will almost always see a better price than Millennium will. Why is that? Because Millennium is an informed investor. They have built models that generate alpha with the expectation that their trades will make money. Citadel is well aware they are streaming prices to Millennium and they need to be mindful of Millennium’s ability to move markets. As such, Citadel will stream much wider pricing (forcing Millennium to pay more to trade) than they would to you at Robinhood. I’ll note here that the set up Citadel has with Millennium is called a Single Dealer Platform (SDP), which is similar to the prop AMM’s appearing on Solana.

Millennium now has a decision: they can either send the order to Citadel, who is giving them so-so pricing, or send the order directly to an exchange like Nasdaq. Sometimes Citadel will have better pricing than Nasdaq and sometimes the exchange will have better pricing. Millennium’s order router will check both prices and decide.

Cool, so that is how hedge funds, like Millennium, trade. Order flows from Millennium either directly to an exchange or to a market maker (who is providing wider pricing than it would to retail).

Order Flow Segregation

The key takeaway above is order flow segregation: Citadel gives a different price to you than it does a hedge fund like Millennium. Retail orders get routed directly to market makers while hedge fund orders may have to hit exchanges because market makers are pricing them wide.

This segregation is due to what we call order toxicity. I mentioned it above, but didn’t call it out by name. Millennium is an informed investor and their orders have alpha–they are toxic. More toxic orders get worse pricing from market makers. You, a retail investor, while informed, are likely not building models like Millennium, and therefore Citadel is willing to give you a more favorable price. You are generating benign order flow. There are, of course, ways to quantitatively measure the toxicity of order flow–trading firms are doing this all the time to help them adjust pricing. I won’t elaborate on that secret here.

This segregation is critical. Retail gets better pricing specifically because Citadel knows it’s retail order flow. Benign, uninformed order flow is king. If we didn’t have this segregation, Citadel would have to average out their pricing for both retail and hedge funds into one price. Retail would be far worse off.

The other important feature to point out is what gets left for the exchanges like NYSE or Nasdaq. It’s the toxic order flow! Retail orders almost never make it to an exchange. And for firms like Millennium they will only route to an exchange if they can’t get a better price from their market makers. That occurs when Citadel has deemed Millennium’s order flow too toxic and would prefer it to go to an exchange. Ultimately, exchanges are known to get left with the most toxic order flow–the leftovers.

Now, let’s apply this thinking to crypto. The first thing you’ll realize is that there is almost no order flow segregation at all today. You trade on Uniswap or Jupiter just like Wintermute might trade on Uniswap or Jupiter. And that’s a huge problem! Liquidity providers on Uniswap or Jupiter have to price assets knowing that Wintermute is also trading against the liquidity. The averaging of pricing between toxic and non-toxic flow, that I mentioned above, is occurring. If we could segregate retail order flow from that of Wintermute, retail would be better off.

Let’s take a look now at spot crypto market structure, and more importantly how I believe order segregation will arise and shape value accrual.

Spot Crypto Market Structure

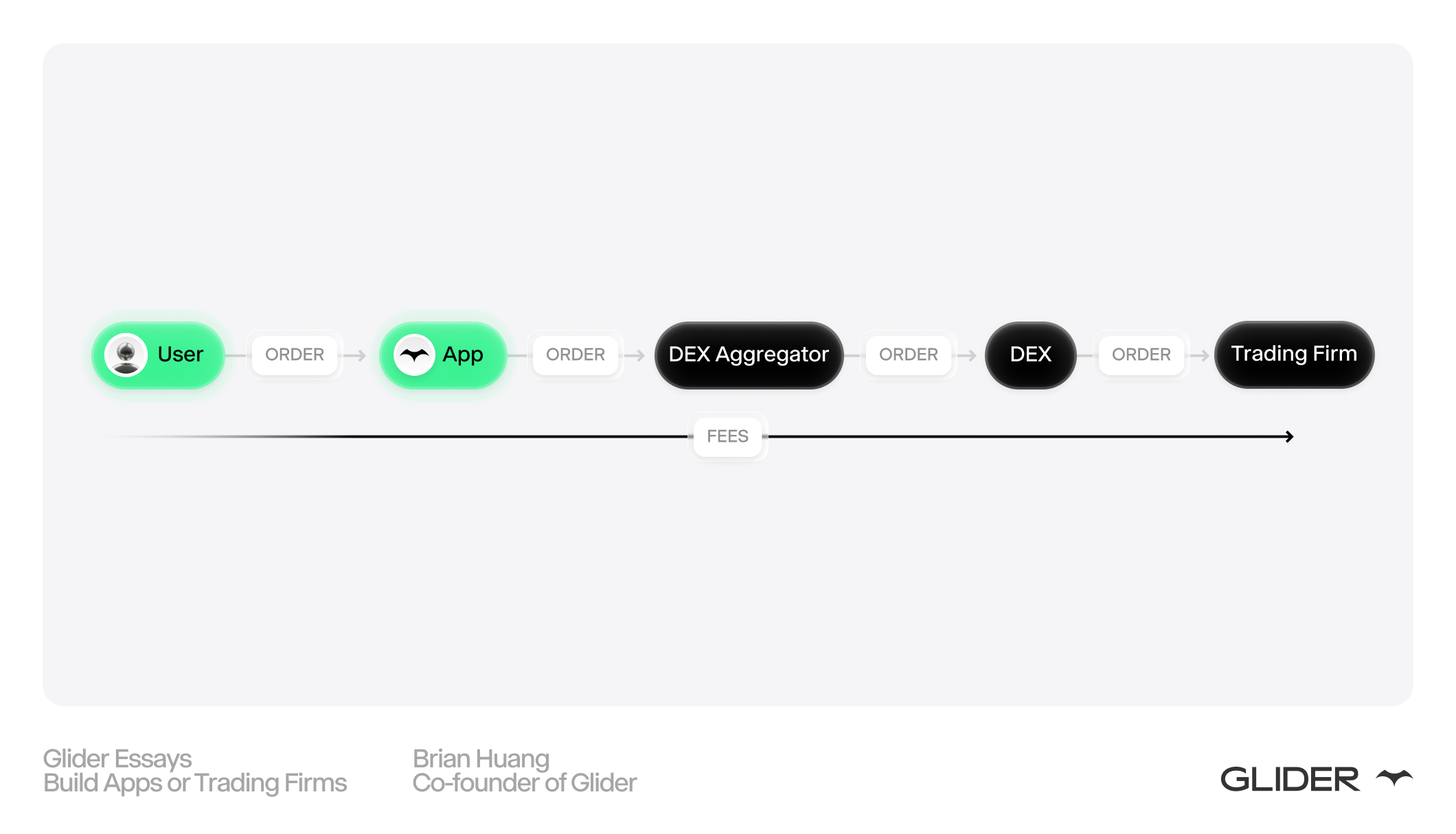

Today, when you place a trade to buy a token in a decentralized app, it almost always goes through a DEX aggregator. For example, at Glider we’ve integrated many DEX aggregators to ensure our users get the best price.

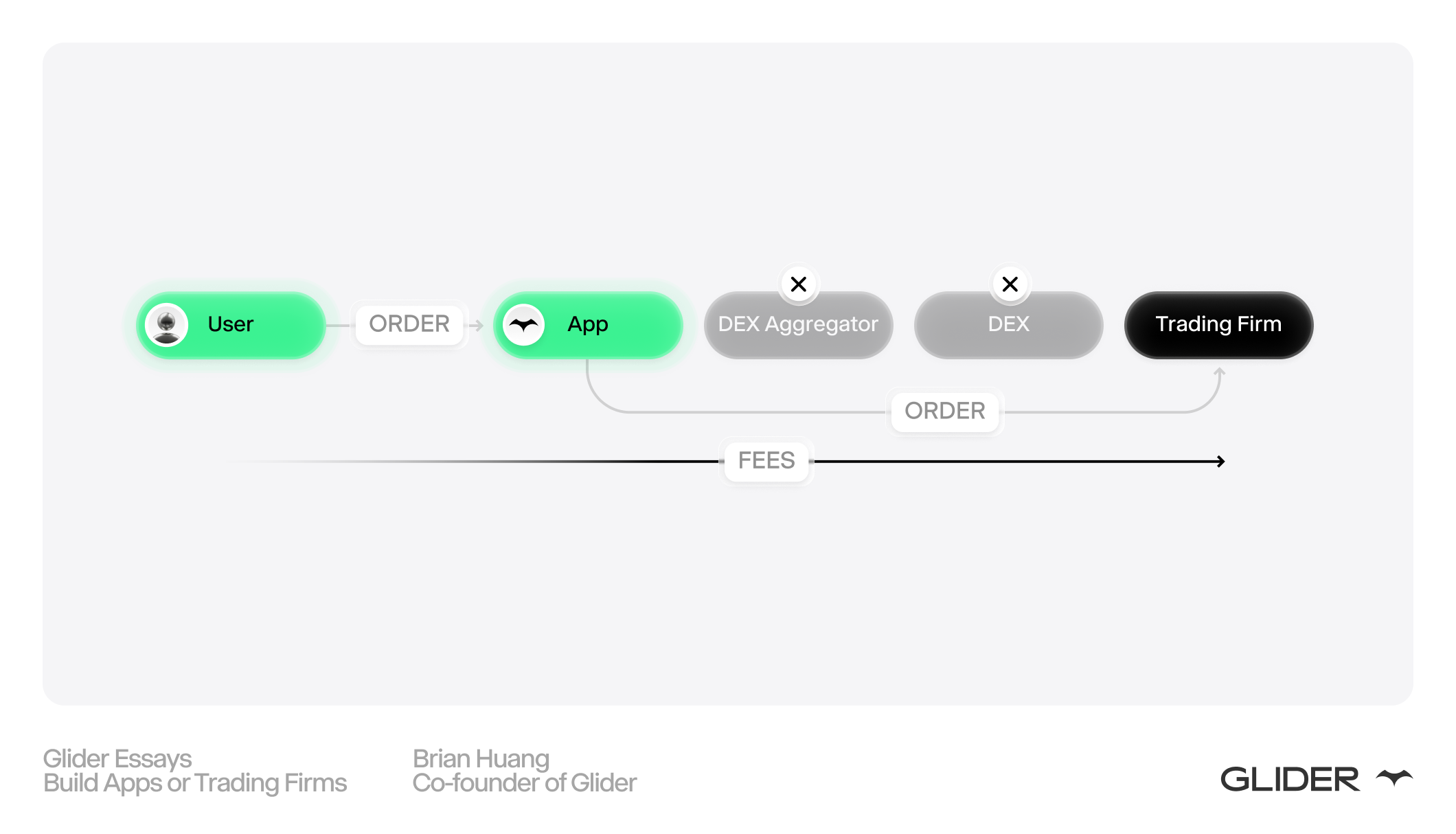

The order placed in an app gets sent to a DEX aggregator, who does the hard work of finding the best price among a number of DEXs and sometimes solvers. The order ultimately hits a DEX and the LPs earn fees every time a trade goes through the AMM.

Breaking this down into a flow of funds, here is what that looks like:

Your order goes from app to DEX aggregator to DEX to LP or market maker. Feels like a lot of middlemen, no? The other problem to call out is that middlemen obfuscate a market’s ability to segregate orders.

Your order from one app gets mashed with a bunch of other orders from another app that then all get mashed into a DEX which is mashing their front end orders with DEX aggregator orders... Every order looks the same at the end. A market maker can’t tell the difference between trading against you and another trading firm.

And as discussed above, that’s a huge problem for retail! When market makers and LPs cannot distinguish who an order is from, you, unfortunately, get the same price as a hedge fund would.

It’s time we change that.

Who are your friends, DEXs?

So let’s cut to the chase, do we need these middlemen? Short answer: no, but it’s nuanced.

As a retail app builder, I should be able to deliver users better pricing by routing directly to a trading firm. Why? Because they know all of our order flow is from retail. We’ve done the work of segregating retail order flow for them. We already see this on Solana, where prop AMMs stream tailored pricing. And they’re winning market share away from the generic DEXs.

So to the question at the top of this section: who are your friends, DEXs? Best price execution for major pairs like ETHUSD is commoditized. You can more or less get the same price across most DEX aggregators, which means apps get to choose. DEXs, have you been building strong relationships with your apps? What would make an app builder want to route order flow to you versus another DEX? It’s going to come down to relationships and incentives.

In order to compete in a world where apps can route order flow directly to market makers, DEXs and DEX aggregators must incentivize and build relationships. One form of incentivization that I see working (that works very well in TradFi) is payment for order flow(!).

Order flow is gold. The fact that orders are charged fees by AMMs is counter to how value should accrue. That would be like if Robinhood paid Citadel for its orders. Instead, what the future looks like is AMMs charging LPs for the order flow. Order flow is valuable because a trading firm can monetize it, and therefore should be paid for. The reason this hasn’t worked so far is because we don’t have order flow segregation. Order flow segregation ensures that hedge funds and trading firms do not get paid for their order flow, but retail does. DEXs, it’s time for you to segregate liquidity into pools for retail and pools for hedge funds. Uniswap V4 hooks are well-equipped to start this process.

If DEXs fail to do it themselves, the natural segregation of order flow will be catastrophic for them over time. Remember what happens when all retail volume goes directly to market makers? Exchanges are left with the most toxic order flow. When toxic order flow is the only thing routed to a DEX, liquidity providers and market makers will pull their liquidity. (Toxic order flow creates impermanent loss for LPs). As liquidity dwindles, so will the trades that get routed to those pools.

We can drive better pricing for retail users by segregating their order flow. DEXs you have the choice to do it yourself or, in time, be cut out of the picture. Take a lesson from the DEX aggregators:

Have you noticed that aggregators are now trying to aggregate markets besides just spot crypto? They are leaning into prediction markets and perpetuals. Why? It’s not about expanding the business, it’s about survival because they don’t have a choice. The aggregators are already getting cut out of the market–their margins are compressing to zero on spot.

Build Apps or Trading Firms

So back to the premise of this piece: build apps or trading firms. Order flow from apps flows to trading firms while value flows back to the users via PFOF.

While not the structure today in crypto, this market structure is inevitable.Why should non-toxic order flow receive the same quote as toxic order flow? There are plenty of trading firms willing to compete for order flow without the DEX aggregators and DEX middlemen. Hopefully, this piece sends some warning flags.

Now, I would be remiss to think these changes happen overnight. DEXs will have their place–especially, in long tail assets that market makers are unwilling to quote. However, the early signs of market share that prop AMMs are gaining on Solana is a clear warning. And we have yet to see more sophisticated players like Citadel or Jump enter the space.

I also firmly believe we will transition into a world where the protocols truly sit at the protocol level. For example, the majority of users who interact with crypto will never trade via the Uniswap front end or lend via a Morpho front end. Instead, those protocols will be hidden behind beautifully crafted apps that combine multiple protocols together.

All of this is to also say that there has never been a better time to build apps in crypto. I’ve seen it personally at Glider. As an app, you get your choice across commoditized infrastructure and part of that is where you route your orders. As the competition for benign order flow heats up, the owners and originators of that flow are incredibly well-positioned over middlemen.

Another thing we think about often at Glider, given my background, is building apps and trading firms. The most valuable companies in the future may sit at the intersection - apps that control order flow and selectively internalize and/or monetize it. Remember, or is not exclusive of and. There are obviously bad historic cases of this when incentives were misaligned (see FTX + Alameda), but done properly, the combination can be powerful. Internally, we have some unique perspectives here, but I’ll leave that discussion for another time.

— Brian 🦇♾️